US-China Negotiations: Between Compromise and Escalation

The week opens with renewed trade talks between the US and China following the latest round of tariff escalation. Washington’s 100% tariffs and Beijing’s export restrictions on rare-earth metals have heightened market uncertainty. The outcome will directly affect key sectors — from technology and autos to industrials and clean energy. Any sign of diplomatic progress could trigger a powerful relief rally, especially in semiconductor and automotive stocks. However, a breakdown in talks risks renewed inflation pressure, supply chain disruptions, and weaker business activity.

Tesla’s Reality Check

Tesla’s (TSLA) earnings on Wednesday are the most anticipated event of the week. Elon Musk’s company will report on deliveries, margins, and production efficiency amid trade tensions and rising competition from Chinese EV makers like BYD. Investors will be looking for updates on autonomous driving, the robotaxi program, and adoption of the new Full Self-Driving v14. The Chinese market remains a focal point, as tariffs and local competition weigh on performance. Beyond autos, analysts will also assess Tesla’s energy storage and solar segments. A strong report could reignite growth stock momentum; a weak one may deepen the recent correction.

Auto and Industrial Crossroads: GM, Ford, and GE in Focus

Tuesday’s reports from General Motors (GM) and GE Aerospace, followed by Ford (F) on Thursday, will provide a detailed snapshot of US industrial health. GM and Ford will reveal progress on EV transition, demand strength, and the impact of trade policies on costs and supply chains. GE Aerospace will offer insights into aviation and defense demand — key indicators of capital spending and confidence. Collectively, these reports may drive a sector rotation if they show clear trends in industrial momentum.

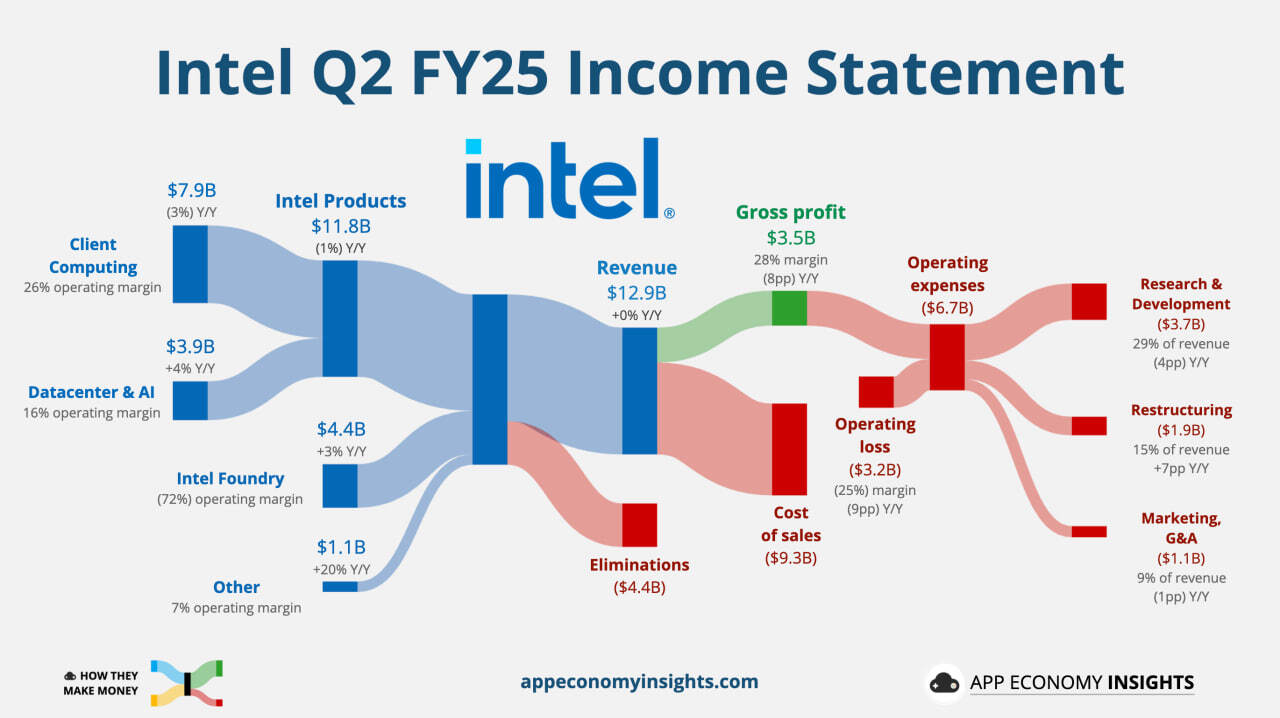

Semiconductors Under Pressure: Intel’s Critical Test

Intel’s (INTC) Thursday earnings arrive at a tense moment for the chip sector. Investors will evaluate demand for data center and consumer processors, as well as AI-related momentum. Commentary on China exposure, rare-earth risks, and domestic manufacturing expansion will be crucial. Weak results could spark another round of selling in semiconductor-heavy portfolios, while strong numbers could restore confidence in tech resilience.

The Week’s Finale: Inflation, PMI, and Housing Data

Friday brings a trio of crucial releases — September CPI, Manufacturing and Services PMI, and new home sales. Together, they will reveal how trade tensions are influencing inflation, production, and consumer demand. Rising CPI could reignite fears of renewed price pressure, while weak PMI data may confirm slowing economic activity. Housing metrics, meanwhile, will test whether higher rates are cooling real estate or if demand remains steady. Combined, these reports will likely shape market direction and Fed expectations heading into Q4.

Subscribe to stay up to date with the latest events in the financial markets.

Telegram: @bigstakeinvest

Twitter: @BigStakeTrades

Telegram: @bigstakeinvest

Twitter: @BigStakeTrades